Scary Spending Stories: Halloween and Social Media

December 12, 2019 By Chris B.

Celebrate a less financially frightening holiday with these tips from Consolidated Credit

Photo by: TBIT

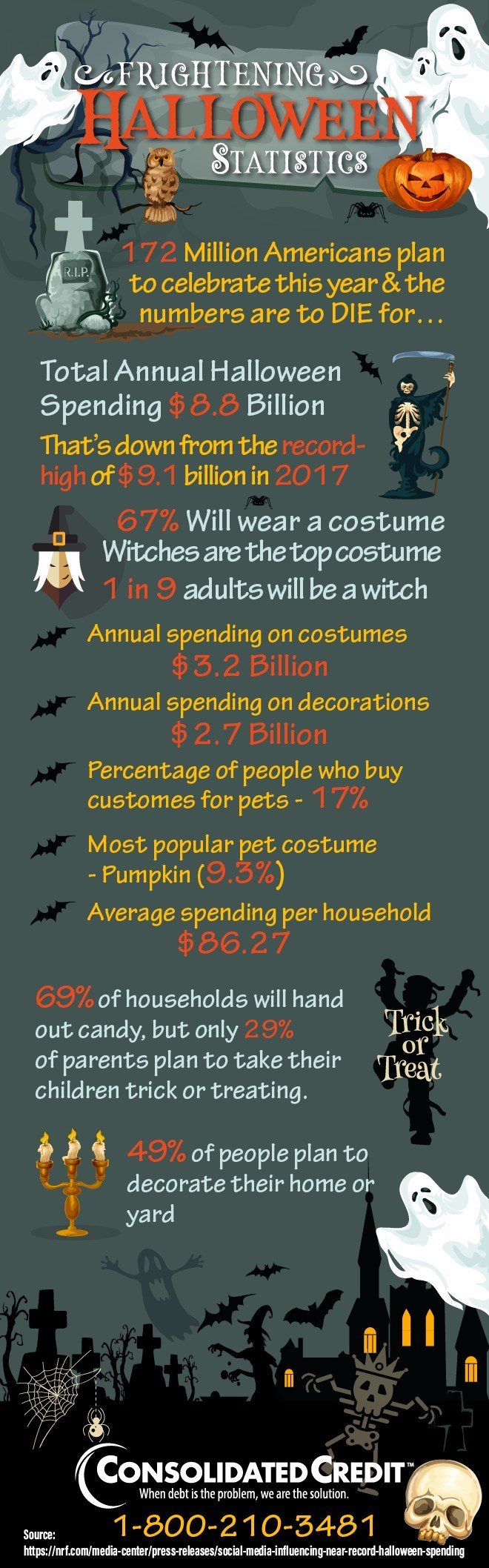

In the last decade, Halloween spending in this country almost doubled, but the reason is really spooky.

"Studies show almost half of all Millennials admit to making Halloween purchases for items just to include them in social media posts," says April Lewis-Parks, Education Director of Consolidated Credit.

She calls the phenomenon "costume envy," and it might be one big reason why Halloween spending rose from $4.75 billion to $8.8 billion in the past decade, according to the National Retail Federation.

"Halloween was once an inexpensive holiday of homemade treats and costumes out of bedsheets," Parks says. "Now we spend hundreds of dollars – only weeks before we spend hundreds more on Christmas and Hanukkah gifts."

Consolidated Credit's certified counselors have for years offered tips for keeping Halloween from becoming a financial horror story...

- Repurpose old Halloween costumes. Take pieces from old costumes to create new ones. For example, a black cape from a batman costume can always double as a cape for a vampire costume.

- Hold a costume swap with your children's friends. By cutting out the price of new costumes, you can drastically cut back your Halloween spending.

- Buy unisex costumes. If you have more than one child, you can reuse the costumes when your other child gets older. Or you can pass the costume onto friends or family who have kids.

- Shop after-Halloween sales. It's never too early to start planning for next year. Many stores have sales for up to 90% off items after the holiday is over.

"Halloween is the one holiday that should be a scary good time, not a scary spending time," Parks says. "It's the one holiday where you can truly have a fun time on a small budget." To see how consumers are spending check out Consolidated Credit's Frightening Halloween Statistics infographic.

About: Consolidated Credit is a nonprofit 501(3)c and has been assisting consumers for over 26 years. Their mission is to assists families throughout the United States in ending financial hardships through financial education and professional credit counseling.